Donations

Your donation provides women and girls in Muskoka with opportunities to develop confidence, enhance skills, find their voices, move out of poverty, and prevent violence.

All donations over $20 are tax deductible. A receipt for income tax purposes will be provided to you.

How to donate:

- Below - fill out the Canada Helps donation form

- Through pre-authorized debit or credit card

- In person - stop by our office and pay by debit, credit, cheque or cash

- Send a cheque through Canada Post to "The Community YWCA of Muskoka", 205 Manitoba Street, Unit 4 Bracebridge, ON P1L 1S3

Give us a call at 705-645-9827 and we will be glad to assist you!

SCAN ME to donate today!

Types of Donations

Monthly Donor:

Canada Helps Monthly giving allows YWCA Muskoka to plan for the future knowing you are committed to supporting those who need us. A small monthly gift is a wonderful and convenient way for you to support the work that you believe in and to ensure sustainability for our organization. Click here to sign up for monthly donations through pre-authorized debits from the banking account of your choice or for credit cards select the donate now icon at the right - all donations are processed securely through Canada Helps.

Donating Securities:

With proper planning, you'll realize even more tax savings than you would with a gift of cash. Not only can the charity issue an official donation receipt (that can be claimed to save taxes) for the value of the publicly traded shares or mutual funds you transfer, you won't have to pay tax on any capital gains realized.

The Canada Revenue Agency does not apply capital gains tax on donations of publicly traded securities. Capitals gains are the increase in the value of your securities over the price you paid at purchase.

When you sell your shares for cash, you’re responsible for the tax due on the gain, even if you plan to donate the proceeds from the sale. If you pay the tax out of those proceeds, there’s less money left to donate. Your charity receives a smaller donation and you have a smaller donation to claim for your charitable tax credit at the end of the year.

But when you donate your securities directly through CanadaHelps, those capital gains aren’t subject to tax. This means your charity receives a larger gift, and you’ll benefit from a tax receipt for the full value of your eligible securities or mutual funds.

To ensure your gift qualifies for a 2023 tax receipt, complete your mutual funds donation before December 8th. All other securities donations before December 15th.

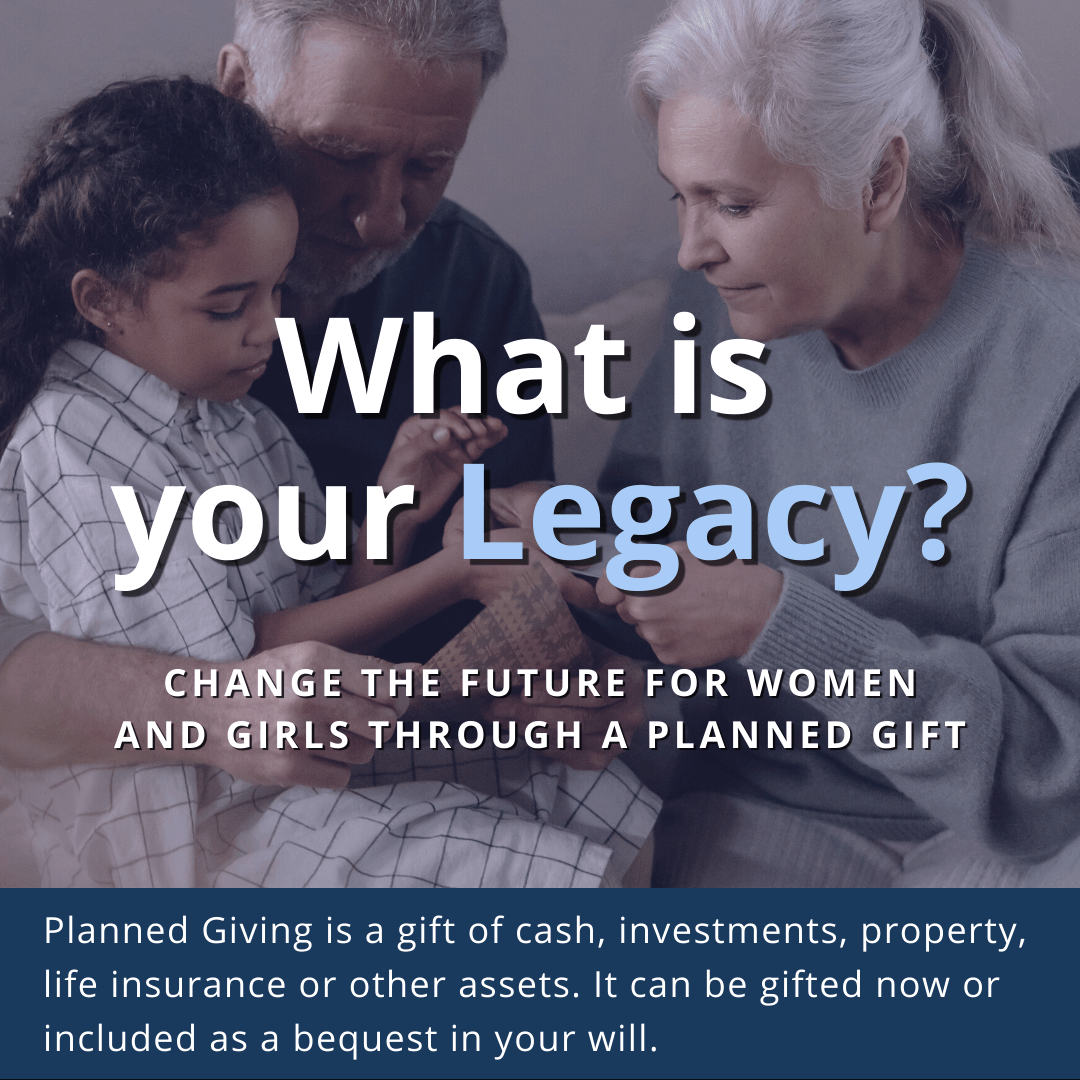

Planned Gifts

A planned gift, or legacy gift, is a pre-designated future donation to a charity, given through a will or other form of designation. It is a decision that each person makes in their own financial planning process, taking into account their charitable wishes and values.

The

YWCA Muskoka Legacy Fund is an ideal place to designate your planned gift. The fund is managed by the Muskoka Community Foundation and was established as a long-term solution to ensure YWCA Muskoka can deliver community-based services throughout the coming decades and beyond.

Other Helpful Information for your legal advisor or financial planner:

Legal Name: The Community YWCA of Muskoka

Charitable Registration Number: 890754021RR0001

Address: 205 Manitoba Street, Unit 4, Bracebridge, ON P1L 1S3.

Annual Donor:

Make a pledge to support the YWCA over a period of years. You decide the length and the amount and where the funds should go; to a specific fund or to help continue all of the work the YWCA Muskoka does.

Celebrate Someone Special by making a Tribute Gift:

Make a donation to honour someone special, or to remember a loved one. At your request, we can send a card to the person or group to let them know that a donation to YWCA Muskoka has been made in their name. You decide where you want your funds to go.

Plan your own fundraising event:

Interested in helping to raise money for the YWCA by hosting an event with your friends, colleagues or community? Third party events can be a huge help to our annual fundraising efforts and the support is truly appreciated.

- Fundraising Toolkit - coming soon

- YWCA Muskoka Fundraising Pledge Form

- YWCA Muskoka Third-Party Fundraiser Interest Form